‘Fiscal Cliff’ talks still uncertain.

It’s less than a month before the ‘fiscal cliff’ but the White House and the Congress are yet to reach a common ground.

It’s less than a month before the ‘fiscal cliff’ but the White House and the Congress are yet to reach a common ground.

Last week, the White House delivered a $1.6 trillion proposal that presses for higher federal tax rates on higher income tax brackets- as well as the power for the President to raise the national debt limit- in an effort to tame the effects of the impending year-end fiscal disaster. Republicans were quick to counter the White House plan with their version of ‘fiscal cliff’ proposal submitted to the Congress on Monday. Republicans strongly oppose federal tax rate increase, and instead aims to avert the effects of tax cut expirations and automatic federal tax rate increases by curbing federal spending on benefit programs such as Medicare and Medicaid.

White House and Republican point persons have been busily running around this week- appearing on interviews to reiterate why or why not federal taxes should increase- but there is still very little progress in the negotiations. Based on the current pace of negotiations, an understanding may not be reached until the day before the ‘fiscal cliff.’

The ‘fiscal cliff’ is the term used to refer to the fiscal crisis to be faced by the US government by the end of 2012 due to the concurrent expiration of federal unemployment benefits and the Bush federal tax cuts, as well as the commencement of the Budget Control Act of 2011. Federal tax rates for payrolls will rise from 4.2 to 6.2 percent and taxpayers will have to pay additional federal taxes for Medicare.

Categories: Federal Tax Tags: buffet rule, federal income tax, federal tax, fiscall cliff, income tax, republican, tax code, tax law, tax reform

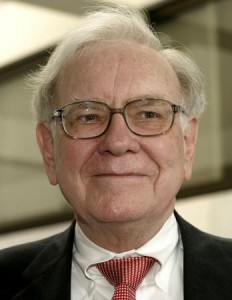

Buffet says raise taxes on the rich

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Buffet, in a recently released op ed is urging congress to compromise on spending cuts and increases on those he coins as the “ultrarich”

Congress, who returned to work after Thanksgiving, will be presented with this op ed in hopes that they make a fair decision when it comes to the looming fiscal cliff. Critics of the buffet rule claim that instigating this type of tax increase will spook investors out of the market. Buffet mocked this idea claiming that in his many years of investing he hasn’t’ seen any sort of tax increases effect the market, ven when capital gains taxes were above 25 percent, well above what they are now.

Buffet serves as the Chairman and CEO of Berkshire Hathaway has been trying to blow the whistle on congress’ treatment of the wealthy for several years. Currently gaining steam President Obama has coined this class warfare as the “Buffet Rule”. This rule seeks to balance the budget in a fair and just manner without causing excess burden on those that can least afford it.

Only time will tell how the fiscal cliff will be dealt with by congress. If Buffet has his way it could mean the “ultrarich” will be paying a lot more in taxes than they do now.

Categories: Federal Tax, Income Tax Tags: buffet rule, federal income tax, federal tax, income tax, tax code, tax increase, tax reform