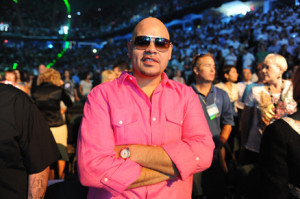

Fat Joe gets a fat payday by evading taxes

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Cartenega made his plea in Newark because that is where some of his companies are incorporated.

The rapper is 40 years on and a native of Miama Beach whos career was launched into the spotlight by such hits as “whats Luv”

The years covered by this prosecution were from 2007-2010 and cost the federal government close to a million dollars in forfeited tax revenue. Cartenega entered guilty please for two counts of tax evasion in a New Jersey courtroom on thursday.

Fat Joe who seemily contradicted his name with his recent weight loss. It is rather an inspirational story seeing as how at one time he was so overweight that he actually earned the name “fat joe”. But with the recent deaths of some great and overweight stars Cartenega decided to turn his life around and became an advocate of health and fitness.

In federal court Thursday, when asked by U.S. Magistrate Cathy Waldor if he understood the charges he was facing, he replied, “I super-understand it.”

Cartagena’s lawyer, Jeffrey Lichtman, said outside federal court that his client “had already taken steps to resolve this situation” before he had been charged. He said the rapper hoped to pay back the taxes by the time of his sentencing April 3.

Cartenega was convicted and his bail was set at a quarter of a million dollars. He could face up to two years in prison and penalties from the IRS of up to a quarter of a million dollars.

Categories: Federal Tax, Income Tax, Tax Evasion, Tax Law Tags: avoiding taxes, fat joe, fat joe tax evasion, federal income tax, federal tax, federal tax fraud, filing taxes, income tax, tax crime, tax evasion, tax the rich

It Pays to Prepare: filing federal tax for 2013

According to the Internal Revenue Service (IRS), now is the perfect time to begin reviewing your federal income tax withholding rate so that you can avoid both big tax refunds and tax bills when you file your federal tax returns next year.

According to the Internal Revenue Service (IRS), now is the perfect time to begin reviewing your federal income tax withholding rate so that you can avoid both big tax refunds and tax bills when you file your federal tax returns next year.

Every year, there are millions of citizens who have to wait for long processes of refunds simply because they have more taxes withheld than the actual required amount. This can prove to be a hassle since they will not be able to access their money immediately. On the other hand, a poorly calculated tax can also lead to having to pay additional taxes on the day of filing.

Jennifer Jenkins, spokesperson for Ohio IRS, said, quote, “By reviewing and adjusting your withholding rate, you are less likely to have to write out a big check in April to pay taxes due. That’s if your withholding is less than it should be. Or, if your withholding rate is too high, adjust it to put more money in your paycheck now. The timing couldn’t be much better for those who are looking ahead to holiday gift-giving season, cold weather heating bills, and end-of-year charitable donations”.

You can make adjustments and modifications to the number of your withholding allowances at any time. Simply check out the different forms available such as the W-4 form at the IRS website (irs.gov). There is also an IRS Withholding calculator to help you fill out your information properly.

Categories: Federal Tax, Income Tax Tags: federal income tax, federal tax, filing taxes, income tax