Buffet says raise taxes on the rich

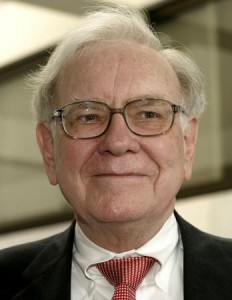

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Buffet, in a recently released op ed is urging congress to compromise on spending cuts and increases on those he coins as the “ultrarich”

Congress, who returned to work after Thanksgiving, will be presented with this op ed in hopes that they make a fair decision when it comes to the looming fiscal cliff. Critics of the buffet rule claim that instigating this type of tax increase will spook investors out of the market. Buffet mocked this idea claiming that in his many years of investing he hasn’t’ seen any sort of tax increases effect the market, ven when capital gains taxes were above 25 percent, well above what they are now.

Buffet serves as the Chairman and CEO of Berkshire Hathaway has been trying to blow the whistle on congress’ treatment of the wealthy for several years. Currently gaining steam President Obama has coined this class warfare as the “Buffet Rule”. This rule seeks to balance the budget in a fair and just manner without causing excess burden on those that can least afford it.

Only time will tell how the fiscal cliff will be dealt with by congress. If Buffet has his way it could mean the “ultrarich” will be paying a lot more in taxes than they do now.

Categories: Federal Tax, Income Tax Tags: buffet rule, federal income tax, federal tax, income tax, tax code, tax increase, tax reform

Airgas Exec angry about federal tax being ‘uneven’

Peter McCausland, the Executive Board Chairman of Airgas Inc., protests what he calls the ‘unfair’ federal law that makes his employees pay higher income taxes than the multi-million dollar private equity people. He goes to say that his employees, numbering more than 14,000, include everyone from managers to truck drivers, and that this unfair taxation is making them lose a lot of money.

Peter McCausland, the Executive Board Chairman of Airgas Inc., protests what he calls the ‘unfair’ federal law that makes his employees pay higher income taxes than the multi-million dollar private equity people. He goes to say that his employees, numbering more than 14,000, include everyone from managers to truck drivers, and that this unfair taxation is making them lose a lot of money.

The tax break was made in order to incentivize new businesses. However, McCausland defends what he says is a loophole in the law. “If a private-equity guy invests his own money, that should qualify for capital-gains treatment. But the income he gets from [investors’] money should be taxed like ordinary income.” At the moment, high-level business only get to pay a mere 15 percent of capital gains tax instead of paying the income and payroll taxes that employees have to suffer.

He voiced out his concern by writing a letter each to two United States Senators, namely Robert Casey, a democrat, and Pat Toomey, a republican. “If the private-equity people paid income taxes at ordinary rates, and if corporations paid taxes on foreign income, and if Amazon paid sales tax, the system would be more fair”, says McCausland. However, both Senators defended the law in their replies.

McCausland told reporters “Both the Republicans and the Democrats were reluctant to come out and say this is a loophole we ought to close… It’s a ridiculous position. It’s fundamentally unfair.”

Categories: Federal Tax, Tax Law Tags: federal tax, income tax, tax code, tax increase, tax reform