BIR: Nobody is an exception against tax evasion

Politicians and wealthy personalities are not exempted to pay their fair share of taxes to the government.

Politicians and wealthy personalities are not exempted to pay their fair share of taxes to the government.

Bureau of Internal Revenue (BIR) commissioner Kim Henares emphasized in the course of criticism that the BIR has gone cheating on asking the small-time individuals to pay taxes and getting the rich people away from any tax obligations.

Henares also addressed this leakage towards self-employed and professional workers who are not giving up their financial obligation to the government.

The Professional Regulations Commission hereby showed that there were 3 million registered professionals, among them doctors and lawyers who earned more than their waged worker counterparts.

Taxpayers remitting their shares fairly would have had a big impact to the progress of the country and would be able to reach a collection goal of Php 768.3 billion, 62.7 percent of BIR’s total collection goal (Php 1.225 trillion) for this year.

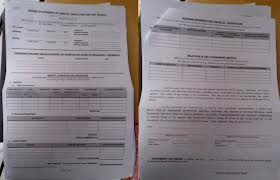

To counter this problem, the government plans to enhance the audit process through the use of technology and information-based solutions. These would help to identify the country’s taxpayers which are at high-risk of non-compliance.

It also intends to improve information linkages with other government agencies through statistical analysis.

If all are traced reasonably, it would be a good implication that the country tends to boost its revenue collection for the implementation of the local and national projects; giving rise to the law-abiding citizens and a fair status at all levels of the society.