Massachusetts Tax

Massachusetts State Tax

Massachusetts Income Tax

The Massachusetts Department of Revenue administers the state’s tax collection. Residents of Massachusetts are subject to a number of taxes including income tax, property tax, and sales tax. State and local taxes help fund local government operations, state schools, and projects.

The Massachusetts Department of Revenue administers the state’s tax collection. Residents of Massachusetts are subject to a number of taxes including income tax, property tax, and sales tax. State and local taxes help fund local government operations, state schools, and projects.

Massachusetts Personal Income Tax

The personal income tax rate in Massachusetts is 5.3% for all incomes- the highest rate collected by a state that has flat income tax rate. Individual tax returns must be filed to the Massachusetts Department of Revenue on or before April 15 of each year.

Massachusetts Corporate Income Tax

Companies must file both state corporate income tax and federal income tax returns. The corporate income tax is business tax collected from all businesses and companies registered in the state. The current corporate income tax rate in Massachusetts is 8% for all income levels.

Massachusetts Property Tax

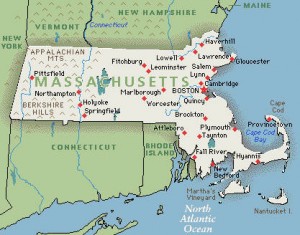

The average property tax rate collected in Massachusetts is 1.04% of a property’s fair market value. The highest state property tax rates are levied in Middlesex County, while the lowest rates are collected in Berkshire County.

Massachusetts Sales Tax

The State of Massachusetts levies 6.25% sales tax on purchases made in the state. Some products and services are exempted from sales tax. Among these items are groceries, admission sales, resold business purchases, and food and clothing items below $175.

There are no local taxes and special sales tax jurisdictions in the Massachusetts. However, pre-made and restaurant food are subject to additional 0.75% special tax. Items purchased from outside the state are subject to 6.25% use tax.