Tax Fraud

IRS Fraud

Tax Evasion

Generally, tax fraud covers a broad area. It could mean as avoiding taxes or any forms of tax deception. Tax fraud is influenced by a number of factors such as tax evasion or corruption. Get to know more about taxes and tax abuse through this article. Read on.

Tax

Tax refers to the fee that is charged by the government on various products, activities and incomes. It’s not considered as donations but rather enforced payment/charges imposed by law. It can be a direct or an indirect tax depending on the modes of charges. Direct tax is charged directly to an individual’s income, either personal or corporate. On the other hand, indirect tax is charged on prices of goods and commodities as well as services. Taxes are very important because it served as one of the strong foundations of state’s development such as developing government infrastructures and improving services. If an individual fails to pay, he/she is entitled to face the consequences of punishment by law. Therefore, tax filing is an important step and process to get rid of any punishment imposed by the government.

What are taxes?

Individual income tax refers to your annual income. Once an individual starts to earn money, he/she is obliged to submit the tenth part of their annual income as their state tax payment. This type of tax is a progressive one. That means, the higher your income the higher your tax.

Corporate income tax refers to the corporation’s income, excluding the qualified deductions.

Estate and gift tax are imposed as federal taxes on any inherited assets and gifts (dollar amounts).

Employment tax includes Medicare and Social Security. This type of federal tax is imposed on both parties (employers and employees). In fact, employers are more responsible for employment taxes for the Federal Unemployment Tax or FUTA.

Excise taxes are taxes that are imposed on several goods such as alcoholic beverages, gas, firearms, tobacco products and etc.

In some places like in the United States, U.S government offers special tax advantage/benefit to boost socio-economic objectives like lowering the homeowner’s taxation. This is called as tax break, tax credit, tax exemption or tax deduction.

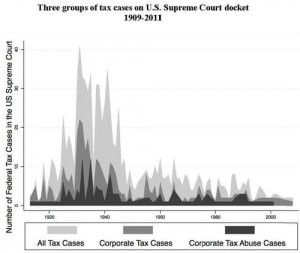

Tax Fraud Cases

There are several cases of tax fraud, such as tax evasion and corruption. Tax evasion or avoiding tax charges through under-invoicing and mis-declaring the quantity and even the descriptions of the products is prohibited by law.

Smuggling is also forbidden by law. It refers to the exportation and importation of products via illegal routes. Since smugglers deliver their goods via illegal processes, they are not subject to any tax charges that are imposed by the government.

Evasion of taxes; sales tax and Value added tax is also considered as a form of tax abuse. VAT is a 20th century consumption tax which is very popular throughout the globe. VAT evasion occurs when producers give their fraud reports in their sales amount. However, only the US government is exempted in this modern form of tax (VAT). They are collecting sales taxes only. Canada imposes VAT at federal level and uses sales taxes in their provincial levels.

Additionally, in some jurisdictions that levy VAT and sales taxes also require their citizens to state and pay taxes on their purchased items in some other jurisdictions. Thus, consumers who will purchase items in an untaxed area/jurisdiction with an intention of evading any tax charges in their state are considered as law breakers. They are subject to their home jurisdiction’s punishment.

However, tax district’s boundaries in some nations don’t have the accurate resources in enforcing their tax collections on some goods that are transported by private vehicles. Therefore, states pursue only on the collection of sales tax and collecting taxes on items with high value like cars.

Corruption is the most common and the most known form of tax abuse. Generally, corruption is present in all countries and in every department, especially by the tax officials. In fact, there are some tax officials who are in connivance with some other tax payers who want to avoid their tax charges through declaring faulty information on their sales income. Corruption by tax officials is common in underdeveloped and developing countries. It is definitely a menace in the community. It’s one of the root causes of a community’s poverty. In fact, economic crisis are often connected with corruption. A number of people are suffering from poverty due to corruption.

Tax fraud degrade the community’s form of living through the absences of quality government services and infrastructures.

To learn more about tax abuse Click Here