Fair Tax

Use Tax AKA Fair Tax

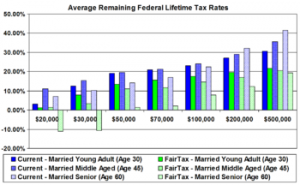

Who really benefits from the fair tax?

Fair taxation for all is an ideal long pursued by lawmakers since the first implementation of taxes. Governments should be fair in imposing horizontal and vertical dimensions of taxation. A fair federal and state tax system exists when there is equality between horizontal and vertical dimensions. There is a violation of the fair tax system when taxpayers are made to pay different amounts of tax. In reality, the concept of fair tax is dependent on an individual’s income. The actual income of the taxpayer is the basis for the calculation of federal and state tax. The same principle also applies for profit organizations and corporations when it comes to paying state and federal tax.

Taxes are considered fair if people will pay taxes federal tax according to their capacity to pay. Since the funds of government are taken from taxes, taxpayers expect to benefit from it. There is fair tax when the people who pay taxes receive benefits from the government through different projects for the good of all. The government is also expected to grant tax breaks to businesses to promote trade and commerce.

Taxation is the collection of money from individuals and the organizations of the country to pay for the goods and services that the government will provide. Taxation can take the forms of direct or indirect. Direct taxation is made by a deduction from income. Indirect taxation happens when tax is added to the price of the goods and services. This isalso called a tax on consumption of goods and services. The percentage of the direct and indirect taxation will vary depending on the country.

Federal and state tax is composed of different kinds of taxes. Income tax is the greater percentage of revenues that were collected by the government. Every person has an allowance for income tax. When a person will reach the maximum allowance for income tax as his income, he will enjoy free tax. Above the allowed income tax allowance, there is a corresponding tax bands with a different tax rate applied. The income of the tax payer is evaluated for tax according to the approved order. Income that was generated from employment will be the first to be deducted by tax. This is to be followed by the income from savings and then dividends.

Value added tax is the government’s third largest source of funds. The value added tax has a standard or fixed rate percentage on goods and services. It is considered a tax on consumption. There are certain goods and services that are exempted from value added tax. There are other goods with a low rate while others have none. Another tax imposed is inheritance tax. This is a tax imposed when there is a transfer of value of any kind.

The importance of taxation for civil society and the state has been evident. Taxation also manifests a wide variety of political and social interpretations. It also cannot be denied that taxation contributes greatly to government and the progress of civil society. Taxation creates a relative distribution of wealth and promotes the growth of commerce and industries. Without the system of taxation, wealth will be unevenly distributed. There will be a bigger gap between the rich and the poor and the wealth of the country will not be managed well without the government. Taxation promotes order and growth.

Since its collection, many tax reforms have been proposed to make it equitable for all. Tax laws have been amended and repealed to accommodate the needs of government and its people. It is in the best interest of all citizens to know their rights before paying their taxes. It is important to know if an individual is entitled to tax exemptions and tax breaks. Preparation and filing services are popular among taxpayers who want to eliminate the hassle of filing tax returns. These services are available to help taxpayers calculate the taxes they are required to pay when tax filing season comes.

Since its collection, many tax reforms have been proposed to make it equitable for all. Tax laws have been amended and repealed to accommodate the needs of government and its people. It is in the best interest of all citizens to know their rights before paying their taxes. It is important to know if an individual is entitled to tax exemptions and tax breaks. Preparation and filing services are popular among taxpayers who want to eliminate the hassle of filing tax returns. These services are available to help taxpayers calculate the taxes they are required to pay when tax filing season comes.

Filing state and federal tax returns have become easier since the invention of tax software. There are free and paid types of tax software that taxpayers can choose from. Since the invention of these online systems, federal and state taxes are computed more accurately.

The collection of taxes should be strictly imposed for the benefit of the public. Tax evaders must be pursued to implement the ideals of a fair tax system. The people will see that there is fair tax collection if those who escape taxes are imposed penalties. Fair tax essentially means equality for all.

To learn more about taxes in general Click Here