Payroll taxes are set to rise

Capitol Hill- Looks like whether or not we plunge off the fiscal cliff won’t matter for some tax hikes. It looks as if come hell or high water payroll taxes are set to rise once again.

Capitol Hill- Looks like whether or not we plunge off the fiscal cliff won’t matter for some tax hikes. It looks as if come hell or high water payroll taxes are set to rise once again.

The payroll tax cut, which has been in effect for the past two years will expire this forthcoming Monday. No talks are underway to even begin thinking about modifying this or changing the fate of this expiring tax cut. On a similar note the fiscal cliff is set to begin next week as well. Unfortunately it looks like no negotiations will be had to resolve this issue and 500 billion in combined tax increases and spending cuts will take into effect next week.

This expiration will result in every single worker seeing their paychecks shrink by over 1,000 dollars next year for individuals making 50,000 a year. The rate will go from 4.2% to 6.2% and benefit Social Security.

These tax increases will take this money out of the economy and have a certain impact on growth of the US economy next year. This will take out of the economy 113 billion dollars or roughly .7% of the annual US output. This will have some impact on the US economy next year seeing as how we have seen sluggish growth for the past few quarters of around 2%.

“They certainly weren’t too keen about publicizing that a lot of money was about to disappear,” said Nigel Gault, chief U.S. economist at IHS. “It will be a surprise to a lot of people that they’ll have less to spend and they’ll have to adjust.”

It seems as if families are already taking into consideration these cuts as individual families this year spent on average 100$ dollars less than in previous years. This is quite strange behavior seeing as how we are supposedly out of the recession.

These families will be in for a surprise that will take into effect almost immediately. Most middle class families have a hard time paying the bills and live paycheck to paycheck. It is yet to be discovered as to how these tax increases are set to effect these folks.

According to a recent survey 2 in 5 houses live paycheck to paycheck. This is much higher than in recent years according to the Consumer Federation of America and the Certified Financial Planner Board of Standards.

These pay cuts are also expected to drop the savings rate of individuals because of the decrease of money into the economy.

Originally this payroll tax cut was put into effect in order to stimulate the economy in 2010. In recent times 2001 and 2008 the government actually sent checks to individuals in order to stint a recession.

Only time will tell whether or not this needed tax break will fade otu of existence with minimal effects to the economy or if the US government will slip back into a recession because of the cut of this sorely needed tax break.

Categories: Federal Tax, Income Tax, Tax Law Tags: federal income tax, federal tax, federal tax fraud, fiscal cliff, income tax, payroll tax cut

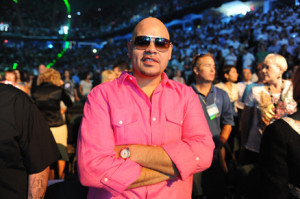

Fat Joe gets a fat payday by evading taxes

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Cartenega made his plea in Newark because that is where some of his companies are incorporated.

The rapper is 40 years on and a native of Miama Beach whos career was launched into the spotlight by such hits as “whats Luv”

The years covered by this prosecution were from 2007-2010 and cost the federal government close to a million dollars in forfeited tax revenue. Cartenega entered guilty please for two counts of tax evasion in a New Jersey courtroom on thursday.

Fat Joe who seemily contradicted his name with his recent weight loss. It is rather an inspirational story seeing as how at one time he was so overweight that he actually earned the name “fat joe”. But with the recent deaths of some great and overweight stars Cartenega decided to turn his life around and became an advocate of health and fitness.

In federal court Thursday, when asked by U.S. Magistrate Cathy Waldor if he understood the charges he was facing, he replied, “I super-understand it.”

Cartagena’s lawyer, Jeffrey Lichtman, said outside federal court that his client “had already taken steps to resolve this situation” before he had been charged. He said the rapper hoped to pay back the taxes by the time of his sentencing April 3.

Cartenega was convicted and his bail was set at a quarter of a million dollars. He could face up to two years in prison and penalties from the IRS of up to a quarter of a million dollars.

Categories: Federal Tax, Income Tax, Tax Evasion, Tax Law Tags: avoiding taxes, fat joe, fat joe tax evasion, federal income tax, federal tax, federal tax fraud, filing taxes, income tax, tax crime, tax evasion, tax the rich

Federal Tax Fraud Perpetrator Gets Conviction

Jorge Castellanos, 49, a businessman from Cummings was convicted to four years in prison following false personal income tax returns filed by Jorge in 2006 and 2007. He was found and pleaded guilty earlier this year in September after federal prosecutors identified the false claims made.

Jorge Castellanos, 49, a businessman from Cummings was convicted to four years in prison following false personal income tax returns filed by Jorge in 2006 and 2007. He was found and pleaded guilty earlier this year in September after federal prosecutors identified the false claims made.

“This office will continue to aggressively prosecute individuals, who knowingly and willfully defy their tax obligations by lying and cheating,” U.S. Attorney Sally Quillian Yates in the news release.

Castellanos along with tow unidentified individuals founded an investment firm in 2004 called GC Trading LLC. The business was founded with the intent of selling overstock golf equipment. However, Castellanos maliciously convinced his partners and investors to make transactions that went directly into his personal bank account. The funds, which were intended to go towards buying merchandise, instead went to fulfilling his own grandeur needs.

Accountants questioned the source of the funds and were told that they were sourced from loans. Lying on your tax return is a federal offense and Jorge seems to have paid the ultimate price. The false tax returns led to a tax loss of $1.3 million dollars ultimately leading to Jorge Castellanos arrest and prosecution.

Hopefully this conviction will be a lesson learned to those who want to take advantage of the federal government by committing tax fraud.

Categories: Federal Tax, Tax Evasion, Tax Law Tags: avoiding taxes, federal income tax, federal tax, federal tax fraud, income tax, tax crime, tax evasion