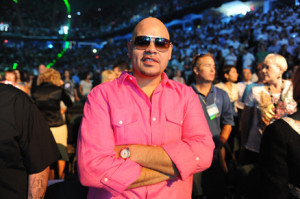

Fat Joe gets a fat payday by evading taxes

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Cartenega made his plea in Newark because that is where some of his companies are incorporated.

The rapper is 40 years on and a native of Miama Beach whos career was launched into the spotlight by such hits as “whats Luv”

The years covered by this prosecution were from 2007-2010 and cost the federal government close to a million dollars in forfeited tax revenue. Cartenega entered guilty please for two counts of tax evasion in a New Jersey courtroom on thursday.

Fat Joe who seemily contradicted his name with his recent weight loss. It is rather an inspirational story seeing as how at one time he was so overweight that he actually earned the name “fat joe”. But with the recent deaths of some great and overweight stars Cartenega decided to turn his life around and became an advocate of health and fitness.

In federal court Thursday, when asked by U.S. Magistrate Cathy Waldor if he understood the charges he was facing, he replied, “I super-understand it.”

Cartagena’s lawyer, Jeffrey Lichtman, said outside federal court that his client “had already taken steps to resolve this situation” before he had been charged. He said the rapper hoped to pay back the taxes by the time of his sentencing April 3.

Cartenega was convicted and his bail was set at a quarter of a million dollars. He could face up to two years in prison and penalties from the IRS of up to a quarter of a million dollars.

Categories: Federal Tax, Income Tax, Tax Evasion, Tax Law Tags: avoiding taxes, fat joe, fat joe tax evasion, federal income tax, federal tax, federal tax fraud, filing taxes, income tax, tax crime, tax evasion, tax the rich

Federal Tax Fraud Perpetrator Gets Conviction

Jorge Castellanos, 49, a businessman from Cummings was convicted to four years in prison following false personal income tax returns filed by Jorge in 2006 and 2007. He was found and pleaded guilty earlier this year in September after federal prosecutors identified the false claims made.

Jorge Castellanos, 49, a businessman from Cummings was convicted to four years in prison following false personal income tax returns filed by Jorge in 2006 and 2007. He was found and pleaded guilty earlier this year in September after federal prosecutors identified the false claims made.

“This office will continue to aggressively prosecute individuals, who knowingly and willfully defy their tax obligations by lying and cheating,” U.S. Attorney Sally Quillian Yates in the news release.

Castellanos along with tow unidentified individuals founded an investment firm in 2004 called GC Trading LLC. The business was founded with the intent of selling overstock golf equipment. However, Castellanos maliciously convinced his partners and investors to make transactions that went directly into his personal bank account. The funds, which were intended to go towards buying merchandise, instead went to fulfilling his own grandeur needs.

Accountants questioned the source of the funds and were told that they were sourced from loans. Lying on your tax return is a federal offense and Jorge seems to have paid the ultimate price. The false tax returns led to a tax loss of $1.3 million dollars ultimately leading to Jorge Castellanos arrest and prosecution.

Hopefully this conviction will be a lesson learned to those who want to take advantage of the federal government by committing tax fraud.

Categories: Federal Tax, Tax Evasion, Tax Law Tags: avoiding taxes, federal income tax, federal tax, federal tax fraud, income tax, tax crime, tax evasion

Nike gets NO NEW TAXES

Oregon- Nike is proposing on being a job creator in Oregon in exchange for a freeze on their state taxes. This proposal could amount to hundreds of jobs for the state which has prompted legistlators to approve this measure as emergency legislation.

Oregon- Nike is proposing on being a job creator in Oregon in exchange for a freeze on their state taxes. This proposal could amount to hundreds of jobs for the state which has prompted legistlators to approve this measure as emergency legislation.

Critics of the approval are suspicious about the timing and intent of this special session. When other legislators were out on holiday break Oregon legislators came together and approved an emergency assurance to one of the largest shoe and athletic companies in the world.

This deal once again proves that Oregon will go to great lengths to protect this corporate giant and all it brings to the state. Money and power has once again tromped common sense and assessing fair taxes equally on all taxpaying parties.

“We have a wonderful, wonderful company that’s going to be remaining in Oregon because of what we’re doing here today,” said Democratic Sen. Ginny Burdick of Portland.

This Nike deal is completely unconventional in a world where tax cuts for the wealthy have become commonplace in the political world.

Due to its emergency nature the meeting cost taxpayers $13,000 and came right before the regular legislation was set to be held. With all of these circumstances the deal seems rather peculiar that it happened in such a manner.

Such factors led Kitzhaber to acknowledge the emergency legislative session was “extraordinarily awkward.”

With this initiative in place Nike has promised to make more than 500 jobs and invest at least $150 million dollars into Oregon’s economy. The bill could be signed as early as next week by the governor.

It is still unclear as to why the emergency legislation took place but one could surmise that Nike may have been threatening to expand outside of Oregon. Nike declined to comment.

In a statement, Nike spokeswoman Mary Remuzzi thanked legislators for acting “quickly and decisively.”

“This is a very positive step forward, not only for our company but for the state of Oregon,” the statement said.

This new infrastructure and job creation is critical in a state that has low property tax, no sales take and relies heavily on personal income taxes. Why in such a tax strapped state legislators are actually giving up tax collection on one of the largest employers in the state. No one knows.

Nike justifies this by claiming that these new jobs to be made are in high income positions and therefore will help bolster the economy.

Nike has been quiet on its new expansion plans or what it plans to do or what the workers plan on doing.

Nike has roots deep within Oregon when it was created in the 1960’s by a runner and his college track coach. Nowadays this company has blossomed into one of the most influential and popular brands in the world. The company is also a very large donor to the University of Oregon.

One can see just how much pull money and power can bring into the legislative sphere. It looks like Nike has their state politicians calling emergency legislative sessions and pulling favors for them. What’s next?

Categories: Income Tax, State Tax, Tax Law Tags: avoiding taxes, corporate tax, federal income tax, federal tax, nike tax, oregon tax, political corruption, state tax, tax increase