$4,000 tax hike for all

Washington- With the way things are heading with this do nothing Congress in regards to making a compromise to avert the fiscal cliff. Countless Americans will be the victims of a sizable tax increase after America falls of the impending fiscal cliff.

Washington- With the way things are heading with this do nothing Congress in regards to making a compromise to avert the fiscal cliff. Countless Americans will be the victims of a sizable tax increase after America falls of the impending fiscal cliff.

What a majority of Americans fail to realize is that their taxes have already gone up. Over 70 tax cuts expired at the end of 2011 which were not renewed. If Congress does not go back and retroactively extend them a typical middle class family could be hit with a $4,000 tax hike when they file their taxes in 2012.

Businesses as well fare to lose dozens of breaks that they have become accustomed to over the years. These tax increases will come from the lost of tax credits given for R & D, expansions or upgrades and tax breaks for financial companies with an overseas presence.

Even if this do nothing Congress does take action it could fare for a big confusing mess for taxpayers to figure out their 2012 tax bills.

“We’re really expecting this upcoming tax season to be one of the more challenging ones on record,” said Kathy Pickering, executive director of The Tax Institute at H&R Block. “For your 2012 returns there’s so much confusion about what will be impacted.”

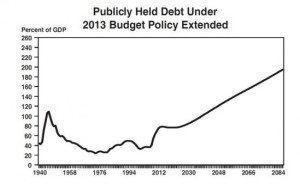

Much of the squabble in Congress right now is focusing on NEW tax increases that will take effect next year. These Bush era tax cuts we have enjoyed for years and now they are scheduled to expire. Also a temporary tax credit on social security is set to expire as well.

Obama is proposing on extending tax cuts for everyone making $250,000 or less and letting tax cuts expire for those individuals that make more that that. If any of you have been following the tax rates enjoyed by the wealthy they currently enjoy not only some of the lowest tax rates in history, they also pay much less than those making less than them. One of the many joys of being able to hire your own accountants and being able to bribe those individuals responsible for making tax legislation decisions.

House Speaker John Boehner and other Republicans have said they are open to more tax revenue through reducing or eliminating unspecified tax breaks. Boehner finally conceded saying that he will raise rates on those earning 1 million dollars or more in exchange for very very deep spending cuts. A move that didn’t go over well with Obama. Although they say no news is good news this is at least a suggested attempt at negotiations between the two parties.

Unfortunately lost in this whole mess is the tax breaks that have already expired in 2011. Only time will tell if one of the worst congresses in history will get its act together and make some positive change for the American people.

Categories: Federal Tax, Income Tax Tags: do nothing congress, federal income tax, federal tax, fiscall cliff, income tax, republican, Republican Tax, take hike, tax increase, tax law