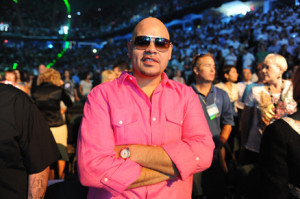

Fat Joe gets a fat payday by evading taxes

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Cartenega made his plea in Newark because that is where some of his companies are incorporated.

The rapper is 40 years on and a native of Miama Beach whos career was launched into the spotlight by such hits as “whats Luv”

The years covered by this prosecution were from 2007-2010 and cost the federal government close to a million dollars in forfeited tax revenue. Cartenega entered guilty please for two counts of tax evasion in a New Jersey courtroom on thursday.

Fat Joe who seemily contradicted his name with his recent weight loss. It is rather an inspirational story seeing as how at one time he was so overweight that he actually earned the name “fat joe”. But with the recent deaths of some great and overweight stars Cartenega decided to turn his life around and became an advocate of health and fitness.

In federal court Thursday, when asked by U.S. Magistrate Cathy Waldor if he understood the charges he was facing, he replied, “I super-understand it.”

Cartagena’s lawyer, Jeffrey Lichtman, said outside federal court that his client “had already taken steps to resolve this situation” before he had been charged. He said the rapper hoped to pay back the taxes by the time of his sentencing April 3.

Cartenega was convicted and his bail was set at a quarter of a million dollars. He could face up to two years in prison and penalties from the IRS of up to a quarter of a million dollars.

Categories: Federal Tax, Income Tax, Tax Evasion, Tax Law Tags: avoiding taxes, fat joe, fat joe tax evasion, federal income tax, federal tax, federal tax fraud, filing taxes, income tax, tax crime, tax evasion, tax the rich

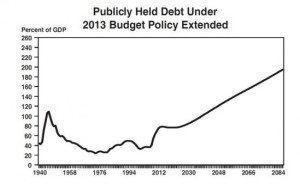

$4,000 tax hike for all

Washington- With the way things are heading with this do nothing Congress in regards to making a compromise to avert the fiscal cliff. Countless Americans will be the victims of a sizable tax increase after America falls of the impending fiscal cliff.

Washington- With the way things are heading with this do nothing Congress in regards to making a compromise to avert the fiscal cliff. Countless Americans will be the victims of a sizable tax increase after America falls of the impending fiscal cliff.

What a majority of Americans fail to realize is that their taxes have already gone up. Over 70 tax cuts expired at the end of 2011 which were not renewed. If Congress does not go back and retroactively extend them a typical middle class family could be hit with a $4,000 tax hike when they file their taxes in 2012.

Businesses as well fare to lose dozens of breaks that they have become accustomed to over the years. These tax increases will come from the lost of tax credits given for R & D, expansions or upgrades and tax breaks for financial companies with an overseas presence.

Even if this do nothing Congress does take action it could fare for a big confusing mess for taxpayers to figure out their 2012 tax bills.

“We’re really expecting this upcoming tax season to be one of the more challenging ones on record,” said Kathy Pickering, executive director of The Tax Institute at H&R Block. “For your 2012 returns there’s so much confusion about what will be impacted.”

Much of the squabble in Congress right now is focusing on NEW tax increases that will take effect next year. These Bush era tax cuts we have enjoyed for years and now they are scheduled to expire. Also a temporary tax credit on social security is set to expire as well.

Obama is proposing on extending tax cuts for everyone making $250,000 or less and letting tax cuts expire for those individuals that make more that that. If any of you have been following the tax rates enjoyed by the wealthy they currently enjoy not only some of the lowest tax rates in history, they also pay much less than those making less than them. One of the many joys of being able to hire your own accountants and being able to bribe those individuals responsible for making tax legislation decisions.

House Speaker John Boehner and other Republicans have said they are open to more tax revenue through reducing or eliminating unspecified tax breaks. Boehner finally conceded saying that he will raise rates on those earning 1 million dollars or more in exchange for very very deep spending cuts. A move that didn’t go over well with Obama. Although they say no news is good news this is at least a suggested attempt at negotiations between the two parties.

Unfortunately lost in this whole mess is the tax breaks that have already expired in 2011. Only time will tell if one of the worst congresses in history will get its act together and make some positive change for the American people.

Categories: Federal Tax, Income Tax Tags: do nothing congress, federal income tax, federal tax, fiscall cliff, income tax, republican, Republican Tax, take hike, tax increase, tax law

Federal Tax Fraud Perpetrator Gets Conviction

Jorge Castellanos, 49, a businessman from Cummings was convicted to four years in prison following false personal income tax returns filed by Jorge in 2006 and 2007. He was found and pleaded guilty earlier this year in September after federal prosecutors identified the false claims made.

Jorge Castellanos, 49, a businessman from Cummings was convicted to four years in prison following false personal income tax returns filed by Jorge in 2006 and 2007. He was found and pleaded guilty earlier this year in September after federal prosecutors identified the false claims made.

“This office will continue to aggressively prosecute individuals, who knowingly and willfully defy their tax obligations by lying and cheating,” U.S. Attorney Sally Quillian Yates in the news release.

Castellanos along with tow unidentified individuals founded an investment firm in 2004 called GC Trading LLC. The business was founded with the intent of selling overstock golf equipment. However, Castellanos maliciously convinced his partners and investors to make transactions that went directly into his personal bank account. The funds, which were intended to go towards buying merchandise, instead went to fulfilling his own grandeur needs.

Accountants questioned the source of the funds and were told that they were sourced from loans. Lying on your tax return is a federal offense and Jorge seems to have paid the ultimate price. The false tax returns led to a tax loss of $1.3 million dollars ultimately leading to Jorge Castellanos arrest and prosecution.

Hopefully this conviction will be a lesson learned to those who want to take advantage of the federal government by committing tax fraud.

Categories: Federal Tax, Tax Evasion, Tax Law Tags: avoiding taxes, federal income tax, federal tax, federal tax fraud, income tax, tax crime, tax evasion