The Consequences Of Tax Evasion In The UK

It is the job of the HM Revenue & Customs office, otherwise known as HMRC, to collect taxes from United Kingdom citizens, and it also will monitor tax payments to ensure compliance. If the HMRC has reason to believe that you may be evading payment of taxes, an investigation will be initiated, and you may face a number of consequences. As a resident of the United Kingdom, it is important to understand this process and the possible penalties.

It is the job of the HM Revenue & Customs office, otherwise known as HMRC, to collect taxes from United Kingdom citizens, and it also will monitor tax payments to ensure compliance. If the HMRC has reason to believe that you may be evading payment of taxes, an investigation will be initiated, and you may face a number of consequences. As a resident of the United Kingdom, it is important to understand this process and the possible penalties.

The Investigation

The HMRC may conduct periodic checks of citizens to ensure compliance with taxation laws, and through these checks, the HMRC may determine that evidence is present indicating tax fraud or evasion. In other cases, a concerned citizen may provide the HMRC a tip that will instigate the investigative process. The investigative process involves the HMRC contacting you directly, and you may choose to comply and participate with the investigation or not. However, the investigation will proceed without your participation. Because of this, it may be in your best interest to work with the HMRC and to provide all documents and supporting evidence requested in a timely manner. Keep in mind that you are permitted to have professional representation during any meetings with the HMRC.

The Process

If your tax payment status is investigated by the HMRC, you may be asked to provide supporting documents or to prepare a disclosure statement to corroborate the amount of taxes that you paid. The HMRC may conduct its own investigation as well, and it may review your tax documents, receipts, bank statements and other financial data. The process may involve several meetings and hearings. Ultimately, the HMRC may determine that evasion did not occur, or you may be required to pay additional taxes. If additional taxes are owed, you may also need to pay interest charges and penalties.

The Consequences

The consequences of tax evasion in the United Kingdom can be damaging in a number of ways. Because those who are caught evading taxes must pay interest charges and penalties on the taxes originally due, there is considerable financial expense associated with this. In addition, many people will choose to pay for professional representation during this process, and there is cost associated with this. The names of those who are caught evading taxes will be published, and there may be an element of public humiliation that a tax evader will be forced to deal with. In addition, some cases of tax evasion may result in criminal charges, and this may cause the guilty party to face additional legal issues. As a final note, those who are caught evading taxes in the United Kingdom often will have their tax returns reviewed more carefully by the HMRC in the future, so there will be added pressure on the individual to ensure that their tax returns are filed truthfully and accurately.

Tax evasion is a serious matter in the United Kingdom, and it can have costly and long-term consequences on your life. The HMRC may be more lenient on those who come forward with their actions or who comply with investigations.

Sally is a content specialist for Francis Clark Tax Consultancy, a business based in South West England who provide tax consultancy services to over 400 firms, visit FCTC.co.uk to find out more.

Categories: Federal Tax, Income Tax, Tax Evasion, Tax Law Tags: tax evasion, taxation, taxes, united kingdom

Chiropractor Guilty of Federal Tax Evasion

Rockford – Cevene Care Clinic owner was found guilty for federal income tax evasion last December 21, 2012.

Rockford – Cevene Care Clinic owner was found guilty for federal income tax evasion last December 21, 2012.

Todd R. Cevene, 42, owner of Cevene Management Group, Inc., Ceven Enterprises, LLC, and, Todd laska Asset Preservation Trust, pleaded guilty for intentionally evading payment of federal income tax. In his plea agreement, he divulged that he has been transferring income from Cevene Care Clinic to his other companies in 2004. He further elaborated that the amassed money were then used to pay for personal expenses knowing that those payments would be improperly used as business expense deductions on entities’ federal income tax returns.

Also in the agreement, he confessed of having most of the money to be transferred directly to his personal account which were not included as income on his personal federal income tax returns.

Cevene admitted that his purpose for transferring the funds to his account was to minimize the risk of exposing his attempts for tax evasion. It has also been found that he made more than one transfer between accounts to make it less suspicious.

Finally, Cevene wrote in the agreement that he owes a large amount of federal income tax for 2004 that he failed to report or pay accordingly. He continued his tax evasion for another 3 years accumulating a total of $91,568 under payment of federal income tax.

Cevene was charged last December 14, 2012 and is scheduled to be sentenced on April 2, 2013. If found guilty, he could have up to five years jail time, with around three years of supervised release after imprisonment and a fine of up to $250,000 plus $500 prosecution costs.

Categories: Federal Tax, Income Tax, Tax Evasion Tags: avoiding taxes, federal income tax, federal tax, federal tax fraud, income tax, tax crime, tax evasion, tax fraud

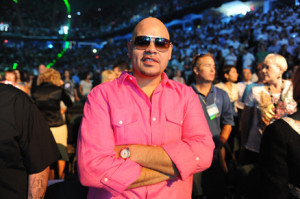

Fat Joe gets a fat payday by evading taxes

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Cartenega made his plea in Newark because that is where some of his companies are incorporated.

The rapper is 40 years on and a native of Miama Beach whos career was launched into the spotlight by such hits as “whats Luv”

The years covered by this prosecution were from 2007-2010 and cost the federal government close to a million dollars in forfeited tax revenue. Cartenega entered guilty please for two counts of tax evasion in a New Jersey courtroom on thursday.

Fat Joe who seemily contradicted his name with his recent weight loss. It is rather an inspirational story seeing as how at one time he was so overweight that he actually earned the name “fat joe”. But with the recent deaths of some great and overweight stars Cartenega decided to turn his life around and became an advocate of health and fitness.

In federal court Thursday, when asked by U.S. Magistrate Cathy Waldor if he understood the charges he was facing, he replied, “I super-understand it.”

Cartagena’s lawyer, Jeffrey Lichtman, said outside federal court that his client “had already taken steps to resolve this situation” before he had been charged. He said the rapper hoped to pay back the taxes by the time of his sentencing April 3.

Cartenega was convicted and his bail was set at a quarter of a million dollars. He could face up to two years in prison and penalties from the IRS of up to a quarter of a million dollars.

Categories: Federal Tax, Income Tax, Tax Evasion, Tax Law Tags: avoiding taxes, fat joe, fat joe tax evasion, federal income tax, federal tax, federal tax fraud, filing taxes, income tax, tax crime, tax evasion, tax the rich