France throws out tax hike on the rich

France- The high court for France struck down a supertax on its nations most elite individuals. This serves as a major blow to President Francois Hollande’s plan to repair France’s economy. This came days before it was proposed to pass the high court.

France- The high court for France struck down a supertax on its nations most elite individuals. This serves as a major blow to President Francois Hollande’s plan to repair France’s economy. This came days before it was proposed to pass the high court.

The high court saw that taxing individuals income over 1.32 million at a 75% tax rate was unconstitutional and highly unfair.

Almost immediately the socialist President vowed to modify and resubmit the proposal which had been passed by the Parliament earlier in the month.

Prime Minister Jean-Marc Ayrault said in a statement that a new proposal to tax the rich “taking into account the principles raised by the Constitutional Council’s decision” would be drawn up as part of the next budget law submitted in 2013 or 2014. No further details of how and when this would be done were given.

The controversial measure was a pillar of Hollande’s success presidential campaign. The measure was proposed on a temporary basis and would effect less that 2000 people in the entire population of France and raise just shy of under a billion dollars during it being in effect. This will hardly solve the financial crisis that burdens this country.

This was just one of several measure s proposed by Hollande to bring down the countries spending deficit to 3% of its gross domestic product. The proposed timeframe for this to occur was within five years or his full term in office.

The measure which was widely support by the leftist wing of the political party drew nothing but criticism from conservatives and business owners that were concerned that such high tax rates would drive wealthy entrepreneurs to flee the country.

These concerns held footing when two of France’s most elite jumped shipped to move to Belgium supposedly to avoid the 75% tax rate. One of those two individuals is world renowned billionare Bernard Arnault, owner of luxury goods company Luis Vuitton.

A number of French nationales already have jumped ship to move to Switzerland, Belgium, and Britain which boast predominately lower tax burdens on the wealthy.

The ruling released by the Council on Saturday struck down the measure because it “failed to recognize equality” The proposed rule change would impact individuals only on income over 1.3 million dollars whereas everyone else in the country would skirt those high tax rates. This tax proposal would indirectly effect a small portion of the population in an unfair manner.

Upon hearing about this unfair ruling Finance Minister Pierre Moscovici recently confirmed that the federal government of France will not drop its pursuit to tax the wealthy to solve its debt crisis.

“Our deficit-cutting path will not be diverted,” Moscovici told BFM television.

Categories: Federal Tax, Income Tax, Tax Law Tags: corporate tax, federal income tax, federal tax, federal tax fraud, french tax, tax law, tax reform, tax the rich

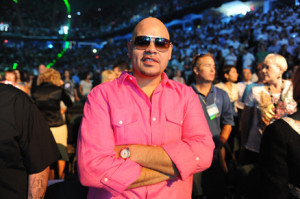

Fat Joe gets a fat payday by evading taxes

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Newark, New Jersey – Famous rapper Fat Joe has been involved in a stint of tax evasion. On Thursday the rapper pleaded guilty to not filing taxes on 3 million dollars in income generated from his music and rap career. Joseph Cartegena or “Fat Joe” was once a billboard topping artist with some of his hits. At one time in his career he was actually a platinum selling artist.

Cartenega made his plea in Newark because that is where some of his companies are incorporated.

The rapper is 40 years on and a native of Miama Beach whos career was launched into the spotlight by such hits as “whats Luv”

The years covered by this prosecution were from 2007-2010 and cost the federal government close to a million dollars in forfeited tax revenue. Cartenega entered guilty please for two counts of tax evasion in a New Jersey courtroom on thursday.

Fat Joe who seemily contradicted his name with his recent weight loss. It is rather an inspirational story seeing as how at one time he was so overweight that he actually earned the name “fat joe”. But with the recent deaths of some great and overweight stars Cartenega decided to turn his life around and became an advocate of health and fitness.

In federal court Thursday, when asked by U.S. Magistrate Cathy Waldor if he understood the charges he was facing, he replied, “I super-understand it.”

Cartagena’s lawyer, Jeffrey Lichtman, said outside federal court that his client “had already taken steps to resolve this situation” before he had been charged. He said the rapper hoped to pay back the taxes by the time of his sentencing April 3.

Cartenega was convicted and his bail was set at a quarter of a million dollars. He could face up to two years in prison and penalties from the IRS of up to a quarter of a million dollars.

Categories: Federal Tax, Income Tax, Tax Evasion, Tax Law Tags: avoiding taxes, fat joe, fat joe tax evasion, federal income tax, federal tax, federal tax fraud, filing taxes, income tax, tax crime, tax evasion, tax the rich

Tax hikes on the rich “negligible” for growth on the economy

Washington- A recent report was re released after Republicans tried to claim that tax hikes on the wealthy would be detrimental to growth in the economy. The report states that revoking the Bush era tax cuts on the wealthiest Americans will have a “negligible” impact on the economy. The report also states that the the Bush Era tax cuts did very little to help spur the growth of the economy. The report also stated that the Bush Era tax cuts helped fuel the income inequality among income classes.

Washington- A recent report was re released after Republicans tried to claim that tax hikes on the wealthy would be detrimental to growth in the economy. The report states that revoking the Bush era tax cuts on the wealthiest Americans will have a “negligible” impact on the economy. The report also states that the the Bush Era tax cuts did very little to help spur the growth of the economy. The report also stated that the Bush Era tax cuts helped fuel the income inequality among income classes.

“Analysis of such data conducted for this report suggests the reduction in the top tax rates has had little association with saving, investment, or productivity growth,” the study says. “It is reasonable to assume that a tax rate change limited to a small group of taxpayers at the top of the income distribution would have a negligible effect on economic growth.”

The study takes into account tax rates and economic growth that dates back to the world war 2 era. Needless to say Democrats pounced on the opportunity to prove to Republicans that tax cut for the wealthy don’t necessarily equate to growth and that the top two percent of earners should go back to Clinton Era tax rates when growth was substantial. Republicans, as they always seem to, complain and swear that raising taxes on the wealthy will only bring gloom and doom for the US economy.

“What this report demonstrates is at the core of the debate we’re having right now,” said Maryland Rep. Chris Van Hollen, the top Democrat on the House Budget Committee, adding that it “put a stake in the heart of the Republican argument that small increases in marginal tax rates for wealthy individuals somehow hurt economic growth.” He also noted that during the Clinton years with tax hikes the US economy was doing a lot better off than when Bush introduced his tax cuts.

“What this CRS report does is take away the last little fig leaf that [Republicans] had to justify big tax cuts for very wealthy individuals,” Van Hollen said.

“Republicans have simply failed to face up to the reality,” said Rep. Sander Levin (D-Mich.), the top Democrat on the House Ways and Means Committee. “I hope that this CRS report will add further impetus to the speaker to sit down with Republicans, because when I’ve talked to a few of them, I don’t think they’ve had this discussion.”

Republican lawmakers claim that the report was written by a left wing study group and that its findings are biased and therefore fallacious.

This is a continuing trend with Republicans denying the facts when they stare them point blankly in the face. Maybe this report will be the wake up call needed to raise taxes on the top 2 percent.

Categories: Federal Tax, Income Tax, Tax Law Tags: federal income tax, federal tax, fiscal cliff, income tax, republican, Republican Tax, Repulbican Tax, tax code, tax pledge, tax reform, tax the rich