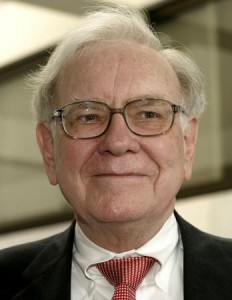

Buffet says raise taxes on the rich

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Buffet, in a recently released op ed is urging congress to compromise on spending cuts and increases on those he coins as the “ultrarich”

Congress, who returned to work after Thanksgiving, will be presented with this op ed in hopes that they make a fair decision when it comes to the looming fiscal cliff. Critics of the buffet rule claim that instigating this type of tax increase will spook investors out of the market. Buffet mocked this idea claiming that in his many years of investing he hasn’t’ seen any sort of tax increases effect the market, ven when capital gains taxes were above 25 percent, well above what they are now.

Buffet serves as the Chairman and CEO of Berkshire Hathaway has been trying to blow the whistle on congress’ treatment of the wealthy for several years. Currently gaining steam President Obama has coined this class warfare as the “Buffet Rule”. This rule seeks to balance the budget in a fair and just manner without causing excess burden on those that can least afford it.

Only time will tell how the fiscal cliff will be dealt with by congress. If Buffet has his way it could mean the “ultrarich” will be paying a lot more in taxes than they do now.

Categories: Federal Tax, Income Tax Tags: buffet rule, federal income tax, federal tax, income tax, tax code, tax increase, tax reform

Resolving the Tax Code Problem

People in California voted on Tuesday to hike the income tax rate on people who make more than $250,000 a year. This is President Barack Obama’s solution to trim the $1 trillion deficit. That’s the easy part though. The difficult part is to come up with the ways to increase the revenues to the U.S. treasury which is a complete reformation of the U.S. tax code. This is difficult in a way that changes in taxes will definitely affect everyone.

People in California voted on Tuesday to hike the income tax rate on people who make more than $250,000 a year. This is President Barack Obama’s solution to trim the $1 trillion deficit. That’s the easy part though. The difficult part is to come up with the ways to increase the revenues to the U.S. treasury which is a complete reformation of the U.S. tax code. This is difficult in a way that changes in taxes will definitely affect everyone.

Up to now, it is still a guess on how this will be done but Dave Camp, Midland Representative, Republican and Max Baucus, Montana’s Sen., a Democratic, are working on it for 2 years now. They are trying to come up with a tax package that will lower the rate across the board and will lessen the deductions, loopholes, credits etc. For now, they come up for an agreement that included $600 billion in new tax collections and they are still working on it until now.

People are now thinking that these two individual are working on an idea conceived when both of them are under the committee responsible to lower the deficit. More than 100 business leaders including Chairman and CEO of The Dow Chemical Co., Andrew Liveris, signed off on a letter just before the Tuesday election which calling for a balanced approach to deficit reduction. Many believed that the deficit decreased matters. Millions of jobs are at risk in having a tax code that is known to be fair.

Categories: Federal Tax, Tax Law Tags: federal tax, tax code, tax reform

IRS on Medical Marijuana Dispensaries

In Washington and Colorado, marijuana is already legal and in 18 other states medicinal cannabis is already allowed. Of course, state-licensed dispensaries will be different in each of these lands. Legislatures and state voters are ok with this but it does not follow that the federal government has the same opinion, especially the IRS.

In Washington and Colorado, marijuana is already legal and in 18 other states medicinal cannabis is already allowed. Of course, state-licensed dispensaries will be different in each of these lands. Legislatures and state voters are ok with this but it does not follow that the federal government has the same opinion, especially the IRS.

Robert W. Wood, Forbes contributor and tax attorney states that the IRS still sees these marijuana dispensaries as drug traffickers but they don’t have any deductions in their taxes. This hurts because businesses are paying their taxes on their net income not on their gross income. Since 1996, medical marijuana is already legal in California. Dispensaries have been fighting against intractable tax policies for years.

The judicial branch, in tax court, is allowing the purveyors to subtract other expenses definite from distributing marijuana which means cannabis outlets can subtract for a 2nd business of care giving. If 10% of the business’s premises are used, the company can deduct most of its rent.

IRS is also fighting for pot deductions in tax court. Martin Olive is a California businessman who is selling vaporizers at his shop. The IRS presented him a large bill and the tax court upheld it. The bottom line here is that dispensaries will walk a tight rope when it comes to IRS deductions. They need to assure the IRS that they are maintaining two businesses, one care giving—under one roof. Because of increased legalization, businesses have better chances to have their case for deductions be heard in federal courts.

Categories: Federal Tax, Tax Law Tags: federal tax, medical marijuana, tax court