Payroll Taxes: A Growing Concern

You think corporations are paying their fair share on taxes? Keep this in mind…in 1969 payroll taxes and federal income taxes accounted for almost the same share of revenue going to our government. Today individuals make up 6 times the amount of corporate taxes. Still think its fair?Tax reform needs to focus on balancing the share of revenue that comes from each source.

Since the 1970’s payroll taxes have almost doubled until they reached about 2/5 of the federal revenue collected. This rise surpassed the single largest source of revenue for the federal government in 2009.

Something needs to be done and no one is stepping up to the plate. The AARP and other social groups show little support for any types of cuts to programs that may jeopardize the social safety net for those most in need. Their argument is that these types of programs help balance the inequality faced by the income classes in our nation.

Of course if you tampered with these payroll taxes and delinked them from the programs they support the government would have to find other sources of revenue to make up any shortfalls that may exist. We can do this by limiting the tax breaks on the wealthy or even revising the tax code to bring in more revenue thereby allowing us to retain and fund some of these programs our most desperate individuals rely on. Other ideas include implementing a carbon tax or a use tax that would disproportionately effect the wealthy and increase revenue generated by the federal government.

With the rising cost of technology in the health care industry and a lack of skilled labor cost will become an issue in the near future. This is one trend we face in the future. Are you ready to face that future?

Categories: Income Tax, Tax Law Tags: federal income tax, federal tax, fiscal cliff, income tax, payroll tax, tax increase, tax law, tax reform

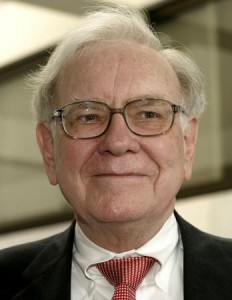

Buffet says raise taxes on the rich

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Buffet, in a recently released op ed is urging congress to compromise on spending cuts and increases on those he coins as the “ultrarich”

Congress, who returned to work after Thanksgiving, will be presented with this op ed in hopes that they make a fair decision when it comes to the looming fiscal cliff. Critics of the buffet rule claim that instigating this type of tax increase will spook investors out of the market. Buffet mocked this idea claiming that in his many years of investing he hasn’t’ seen any sort of tax increases effect the market, ven when capital gains taxes were above 25 percent, well above what they are now.

Buffet serves as the Chairman and CEO of Berkshire Hathaway has been trying to blow the whistle on congress’ treatment of the wealthy for several years. Currently gaining steam President Obama has coined this class warfare as the “Buffet Rule”. This rule seeks to balance the budget in a fair and just manner without causing excess burden on those that can least afford it.

Only time will tell how the fiscal cliff will be dealt with by congress. If Buffet has his way it could mean the “ultrarich” will be paying a lot more in taxes than they do now.

Categories: Federal Tax, Income Tax Tags: buffet rule, federal income tax, federal tax, income tax, tax code, tax increase, tax reform

Tax Code Tweaked

The revised tax code is already a step closer to reality last Monday night at a city council meeting. The amendment’s goal is to lessen the regulations for landlords. The council approved the 2nd reading of the revised penal code. The code has not been revised since 1964. The amendment states that landlords are required to report quarterly the names of their tenants. This was suggested by Councilman Sherrie Curtis wherein the landlord must file the report by the time they renew their license or when they have new tenants.

The revised tax code is already a step closer to reality last Monday night at a city council meeting. The amendment’s goal is to lessen the regulations for landlords. The council approved the 2nd reading of the revised penal code. The code has not been revised since 1964. The amendment states that landlords are required to report quarterly the names of their tenants. This was suggested by Councilman Sherrie Curtis wherein the landlord must file the report by the time they renew their license or when they have new tenants.

Linda Ziegler, Ohio Avenue resident, added that landlords should only include adults in their tenant reports. Before the ordinance will be adopted, it will still have to undergo one more reading. It will be rediscussed at finance committee meetings at 11 a.m. November 13 and 6 p.m. November 19, before the regular council meeting. The chairman of the committee, Curtis, urges everyone who have comments to attend the meeting on November 13 session.

Ziegler and Brian Kerr, both Ohio Avenue resident, states that the addition of an agreement that gas and oil lease royalties are subject to taxing is not necessary. They said that not so much amount can be generated from these royalties within the city limits. Ryan Stovall, former council member and headed the tax code revision said that they need to do it if that what it takes to get the updated code passed. He emphasized that taxes are paid on gambling income but they are not trying to get rich from these royalties.

Categories: Federal Tax, Income Tax, Tax Law Tags: federal income tax, federal tax, income tax, tax code