Grover warns of tea party resurrection; Mitchell: ‘fiscal cliff’ not the problem

With less than one month before the ‘fiscal cliff,’ both White House and Republican parties display an unrelenting tone and are still unable to come up with an agreement that will help avert the effects of the brewing storm of automatic spending cuts and higher federal tax rates by 2013.

With less than one month before the ‘fiscal cliff,’ both White House and Republican parties display an unrelenting tone and are still unable to come up with an agreement that will help avert the effects of the brewing storm of automatic spending cuts and higher federal tax rates by 2013.

Negotiations have been made, but so far no common ground has been reached. President Obama and his Democrat allies have earlier proposed a $1.6 trillion fiscal cliff proposal that presses mainly for higher federal tax rates for the wealthy, which is promptly countered by the $2.2 billion Republican plan that centers on curbing federal tax spending instead of levying higher federal taxes.

In NBC’s “Meet the Press,” Grover Norquist- author of the no-new-taxes pledge and one of the main influences in the GOP debates- warned of a tea party revival if Pres. Obama “pushes the country over the fiscal cliff.”

The fiscal cliff has serious implications: the expiration of the Bush federal tax cuts will raise the current federal tax rates; the expiration of Payroll Tax Cut will raise the rate to up to 2 percent; the commencement of the Budget Control Act will automatically cut back federal tax spending; and the implementation of the Affordable Care Act will result to additional federal taxes.

However, Cato Institute fellow Daniel Mitchell argues that the problem is not the fiscal cliff. “In a competitive global economy, for instance, it is bizarrely self-destructive to increase the double taxation of dividends and capital gains,” writes Mitchell.

Categories: Federal Tax, Income Tax, Tax Law Tags: federal income tax, federal tax, fiscal cliff, grover norquist, republican, tax code, tax pledge, tax reform

Boehner and the Republicans stall fiscal cliff progress again

WASHINGTON: As the election cycle comes to an end the American people spoke with resounding force that fixing the fiscal cliff should involve tax cuts on the wealthy. Republicans seemingly bought into the idea striking down their anti tax pledges and committing to work in a bipartisan manner in getting this issue resolved, however today has proven that both parties are loud on words and short on action. A once bright light of promise has now dimmed to the bleakness of impending doom as Republicans once more stand by their insistence on cutting spending without raising taxes on the wealthy.

WASHINGTON: As the election cycle comes to an end the American people spoke with resounding force that fixing the fiscal cliff should involve tax cuts on the wealthy. Republicans seemingly bought into the idea striking down their anti tax pledges and committing to work in a bipartisan manner in getting this issue resolved, however today has proven that both parties are loud on words and short on action. A once bright light of promise has now dimmed to the bleakness of impending doom as Republicans once more stand by their insistence on cutting spending without raising taxes on the wealthy.

Speaker of the House John Boehner (R Ohio) seemed someone gloomy after having a call with Obama on Wednesday followed by a face to face with Treasury Secretary Tim Geithner the day following. The bid Geithner proposed was Obama’s latest effort to find bipartisan resolve to this neverending crisis. The offer included approximately 1.6 trillion in new revenues by levying a tax on the wealthy while simultaneously cutting spending in a fair and balanced approach.

In this budget included stimulus pork of $50 billion, aid to homeowners underwater in their house payments and unemployment benefit extensions in the amount of $30 billion dollars. The new budget also posed new rules of dealing with raising the debt limit. As you remember this was the the debacle that led to a lowering of our credit rating. A move largely blamed on Republicans unwillingness to compromise.

Boehner was, to say the least, very disappointed. In his mind compromise consists of no give and take just take. With four weeks before the fiscal cliff takes effect, this is no laughing matter. The Republican party needs to begin taking this seriously before these automatic cuts take place sending the economy back into a recession say experts.

Neither party moved from their positions they were previously and Republicans are taking a stand against only raising taxes on the wealthy. These automatic tax increases would affect 98% of the population if something isn’t done soon.

Some think that this is political posturing for a party that is becoming, largely unpopular with the common man, As it stands now if taxes increase on anyone besides the wealthy the Republicans are to blame. This will essentially add a tax hike of over $2,200 to the average household’s tax bill. With 98% of the population at risk for this $2,200 tax increase the Republicans are against the wall and have no where to run.

Republicans no longer have popular support and their arguments against this fair and balanced approach are slowly running out of steam. This political posturing and do nothing congress mentality not only hurts our future, it hurts our image to the rest of the world.

Both sides do agree that a fair and balanced approach needs to be taken to avert this disaster that includes revenue increases as well as spending cuts however the details of that are still a bit unclear. It seems as if the Republicans still insist on balancing the budget on the backs of those that can least afford it so that they can bow to their masters in fur coats.

With this type of persistent name calling and hostage taking by the Republican party who knows when anything will get done. This may be the beginning of the end of the greatest nation on earth. All because of the bullheadedness of bought and paid for federal officials on capital hill.

Categories: Federal Tax, Income Tax Tags: federal income tax, federal tax, fiscall cliff, grover norquist, republican, Republican Tax, tax code, tax pledge, tax reform

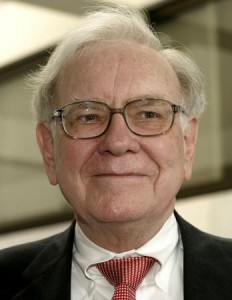

Buffet says raise taxes on the rich

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Warren Buffet, renowned billionaire and investor, is again renewing his bid to have congress assess taxes on the wealthy. With the fiscal cliff looming and many programs on the chopping block, this Buffet rule would raise much needed capital to avert this debt crisis we are facing.

Buffet, in a recently released op ed is urging congress to compromise on spending cuts and increases on those he coins as the “ultrarich”

Congress, who returned to work after Thanksgiving, will be presented with this op ed in hopes that they make a fair decision when it comes to the looming fiscal cliff. Critics of the buffet rule claim that instigating this type of tax increase will spook investors out of the market. Buffet mocked this idea claiming that in his many years of investing he hasn’t’ seen any sort of tax increases effect the market, ven when capital gains taxes were above 25 percent, well above what they are now.

Buffet serves as the Chairman and CEO of Berkshire Hathaway has been trying to blow the whistle on congress’ treatment of the wealthy for several years. Currently gaining steam President Obama has coined this class warfare as the “Buffet Rule”. This rule seeks to balance the budget in a fair and just manner without causing excess burden on those that can least afford it.

Only time will tell how the fiscal cliff will be dealt with by congress. If Buffet has his way it could mean the “ultrarich” will be paying a lot more in taxes than they do now.

Categories: Federal Tax, Income Tax Tags: buffet rule, federal income tax, federal tax, income tax, tax code, tax increase, tax reform